ZEBUNITE is a Middle East centric Corporate Finance Advisory & Investment Banking boutique with the mission of serving as a bridge between Middle East based enterprises and the World.

Founded by Corporate & Investment bankers with 16+ years of prior work experience with Foreign banks such as Citibank & ING, various Cross-Border Investment Banks, Debt broking house and a Hedge Fund with participation in capital raising transactions valued in excess of US$ 12 billion across Sectors, Currencies, Transaction types and Geographies in Middle East, Europe, Africa and India with ticket sizes ranging from US$10mn to US$500Mn. ZEBUNITE is licensed by the Department of Economic Development, Government of Dubai, and governed by the Federal Laws of UAE.

Opportunity seeking to marry Middle Eastern aspirations and sensibilities with western expectations. The primary goal of ZEBUNITE is to connect global pools of capital and new pockets of opportunity with its Middle East market clients thus creating win-win alignments. From its Dubai base, ZEBUNITE apart from raising Local & International Debt for its clients also focuses on Equity Raise and selectively works on M&A opportunities tailored to the needs of its wide ranging Clientele.

The ZEBUNITE power play stems from its ability to deliver very large ticket sizes in a fast, uncomplicated way & perhaps even more eye-catching is its ability to prolifically originate deal flow and execute transactions both locally and internationally. The intensity of our focus on the myriad nuances of Middle East markets including UAE, the depth of our professionals’ experience & breadth of our relationships and reach, all enable ZEBUNITE to produce groundbreaking work when conventional solutions fall short of achieving client goals.

The broad, robust & geographically diverse network of international Lenders & investors covered by ZEBUNITE is the cornerstone of its “Fast Track” financial intermediation capabilities. Often, we cover multiple layers of the capital structure in a single transaction. For the right opportunity, there is no limit. In these challenging times, we are especially equipped to bring innovative solutions tailored to our clients’ needs.

CURRENT FOCUS

ZEBUNITE acts as “Mandated Arranger” and specializes in Capital Raising as follows:

- Capital Structure : Whole spectrum of Debt, Equity and Hybrids

- Currencies : AED, USD, EUR, GBP, GCC currencies

- Sectors : Being a generalist with sector-agnostic approach

- Size of the Company : Turnover from USD20Mn to USD2Bn+

- Company Ownership : Local owned, Expat owned, Financial institution or GREs

- Status type : Publicly Listed as well as Privately held

- Transaction Types : Bilateral, Syndicated, Capital markets

- Life Cycle of Entity : Growing, Matured, Distress & Select Start-up

- Geographical Focus : Transactions with one leg in Middle East

- Ticket Sizes : Generally, from USD10Mn to USD500Mn+

INSTRUMENTS

- DEBT: Term Loan, Structured Finance, Project Finance, Structured Trade & Commodity Finance, Working Capital including non-fund based limits (such as Bank Guarantees, L/Cs, SBLCs, APG, PBG, Surety), Refinancing, Mezzanine Finance, Debt Consolidation, Special Situations Financing, Acquisition Financing, Leverage Buy Outs, Convertibles/Hybrids, Debt Capital Market products; Debt Restructuring, Off-Balance sheet Debt, Islamic Finance, Multilateral / DFI Financing, Hedge Fund Structures

- EQUITY: Private Equity, Preferred Equity, Convertibles (fully, optionally, partially), Equity Warrants, PIPE, Private Placement, Pre-IPO financing, Angel or Seed Funding, Venture Capital, Islamic Finance, Equity Capital Market products

- M&A: Stake Sale, Asset Sale, Management Buy-Outs, Merger, De-merger, Spin-offs, Reverse-merger, Divestments, PIPE, JV, Brand Sale, Commercial alliances, Franchise & Licensing arrangements

INSTITUTIONAL RELATIONSHIPS

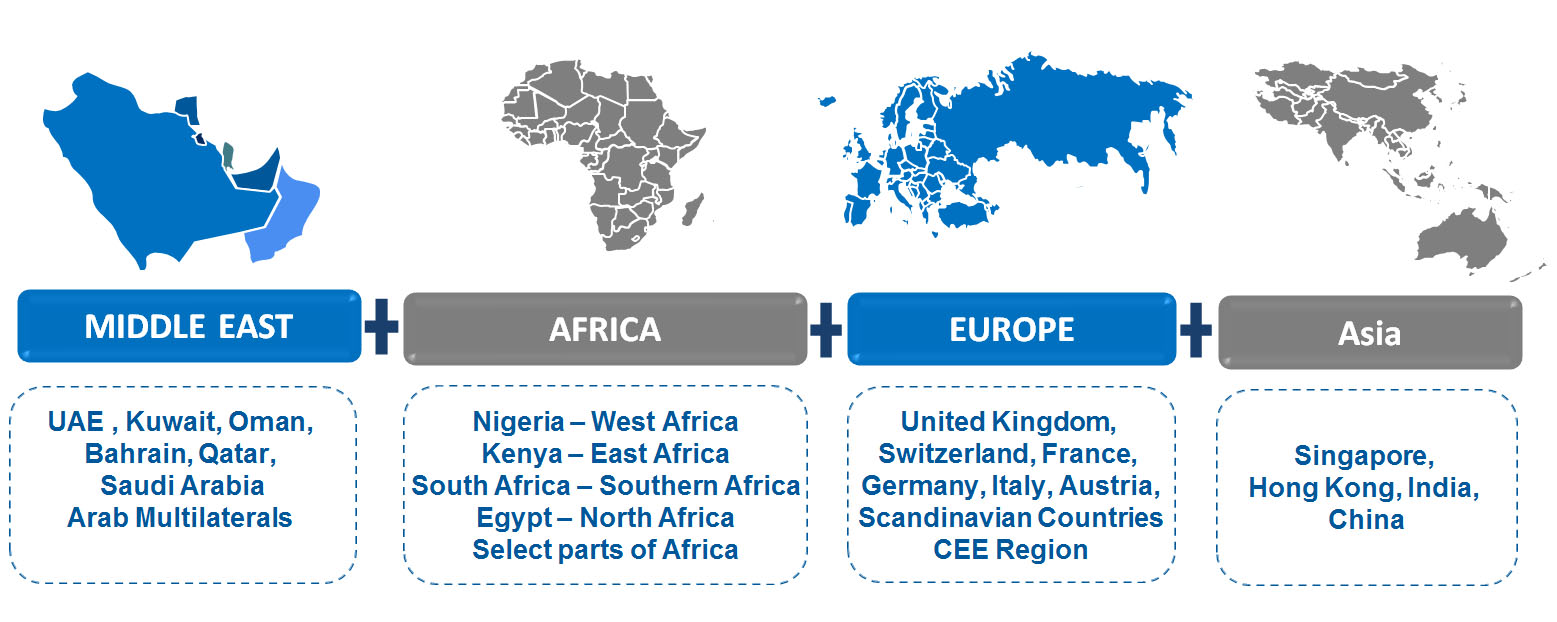

Our Lender / Investor universe is geographically based in:

Our Network spans the entire spectrum:

- Banks (Local, Regional, Foreign & Private), Non-Bank Financing Companies,

- Sovereign Wealth Funds, Development Financial Institutions, Multilaterals,

- Family Offices (Single & Multi), Private Equity Funds, Buyout funds, Crossover Buyers,

- Distress Investment funds, Trade Finance Funds,

- Mezzanine investors, Private Debt Funds,

- Hedge Funds, Pension Funds, Insurance companies, Leasing institutions,

- Select VCs & Angels and other Financial Institutions