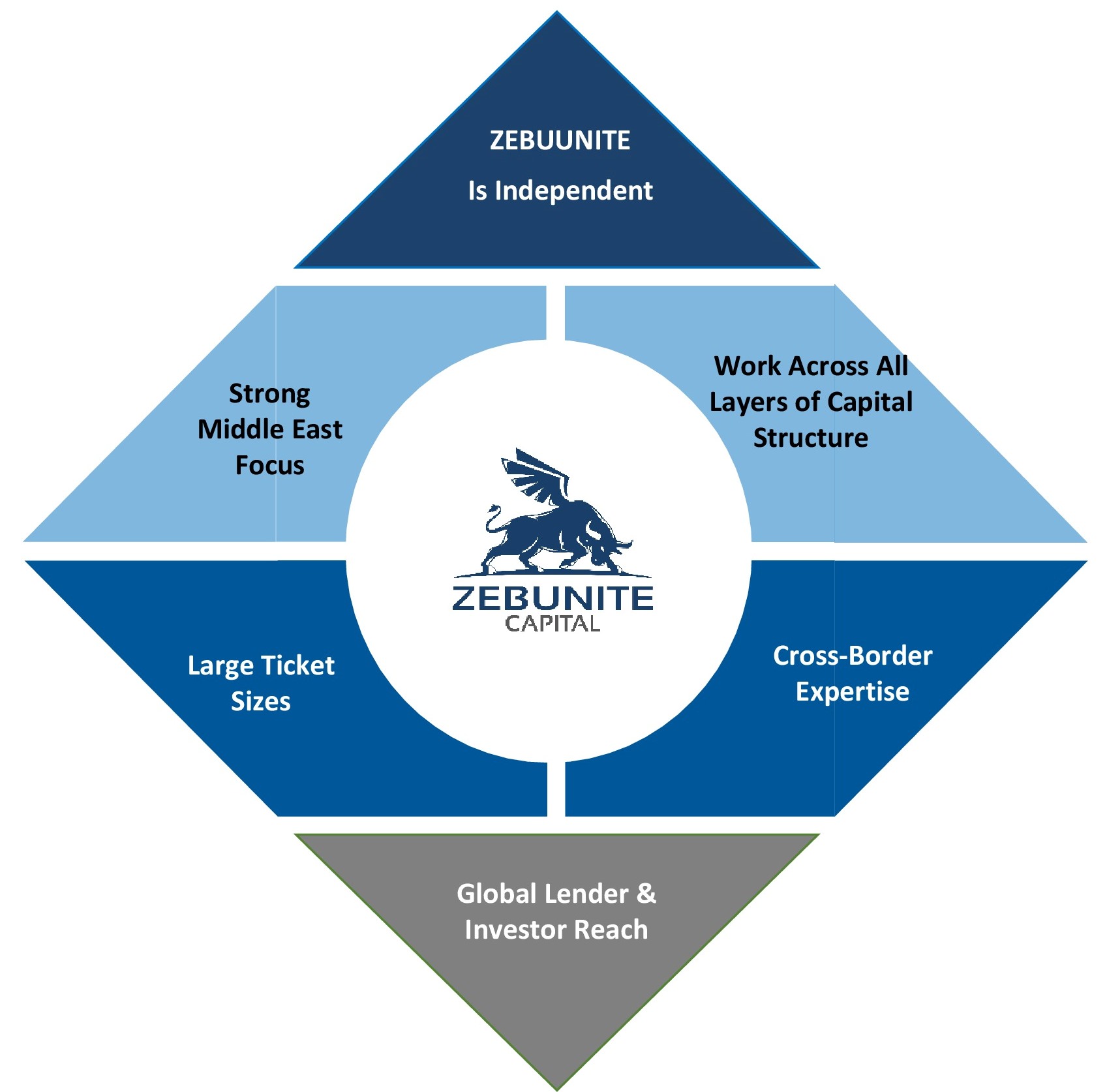

ZEBUNITE Is Independent

- Unlike larger integrated institutions, we have no need to cross-sell other products

- Combining the global reach of a “bulge bracket” investment bank with the personal touch of a “boutique providing insight not just information, generating value not just transactions

Strong Middle East Focus

- For its Middle Eastern clients, is able to add value beyond capital raising through ideation, structuring, transformation, innovation & customization backed by entrepreneurial insights

Work Across All Layers of Capital Structure

- One Stop Shop – We become relevant to clients at each stage of life cycle of Company

- Be it Senior debt, Subordinated debt, Junior equity, convertibles / hybrids or Equity

- We take pride on our Unique Structuring Ability to suit need of the hour

Large Ticket Sizes

- A key differentiator lies in the ability of ZEBUNITE to deliver very large ticket sizes in a fast, uncomplicated way

- ZEBUNITE also believes in constantly shining the spotlight on the unfolding underpinnings of each handled transaction

Cross-Border Expertise

- Having worked in Europe, Middle East, Africa & Indian sub-continent, Senior Management of ZEBUNITE brings cross border expertise

- Can connect well with and be responsive to the needs, sensibilities, aspirations and compulsions of Entrepreneurs

Global Lender & Investor Reach

- ZEBUNITE has the ability to prolifically connect with Lenders / Investors in UAE, Kuwait, Bahrain, Oman, Qatar, KSA, London, Paris, Geneva, Singapore, HongKong, India, selective parts of Africa & Europe, while placing transactions

- ZEBUNITE’s colossal network of institutions includes Banks, Non-Bank Finance Cos., Family Offices, Sovereign Funds, DFI’s, Multilaterals, PE Funds, Mezzanine Funds, Trade Finance Funds, Hedge Funds, Pension Funds, Insurance companies, Leasing institutions, Select VCs & Angels